- Home

- Tax Services

For Individuals

For Business

- Family Law

- Real Estate

- Corporate Services

- Business Sales & Acquisition

- Business Incorporations

- Offshore Incorporations

- Contracts and Agreements

- Business Advisory Services

- Reorganizations

- Amalgamations (mergers)

- S.85 Roll-overs

- Butterfly Transactions

- Shareholder Agreements

- Leases

- Succession Planning

- Business Start-up Planning

- Personal Real Estate Corporations (PREC)

- Agreements

- Wills & Estates

- Contact Us

- About Us

LEGAL SERVICES FOR LAWYERS

Wholesale Legal Services for Lawyers Only

We've got you covered!

How Can We Help You?

We have Provided Representation and

Advice on Hundreds of

Tax Court matters.

01.

File your Notice of Appeal with the Tax Court of Canada.

02.

Help Obtain an Extension of Time in which to Appeal.

03.

Provide you with an Opinion on your Tax Court Case.

04.

Help Negotiate a Settlement for your Matter.

05.

Provide Representation on All Tax Court Matters.

What if You

Disagree with the

Results of a

CRA Objection?

Do you disagree with the Canada Revenue Agency’s (“CRA”) decision resulting from an objection?

Taxpayers have every right to appeal the assessment to the Tax Court of Canada (“TCC”).

With that in mind, there are details that every taxpayer should be aware of before appealing in Tax Court. Firstly, there is a time limit that a taxpayer has to obey. Typically, he or she much file their Notice of Appeal within 90 days from the date Notice of Confirmation or Notice of Reassessment was finalized by the CRA.

Another avenue that taxpayers in this situation must be aware of is the time extension. If the taxpayer is looking for an extension to appeal then he or she has one year after the 90-day time limit has lapsed to submit the application.

What if You

Disagree with the

Results of a

CRA Objection?

Do you disagree with the Canada Revenue Agency’s (“CRA”) decision resulting from an objection?

Taxpayers have every right to appeal the assessment to the Tax Court of Canada (“TCC”).

With that in mind, there are details that every taxpayer should be aware of before appealing in Tax Court. Firstly, there is a time limit that a taxpayer has to obey. Typically, he or she much file their Notice of Appeal within 90 days from the date Notice of Confirmation or Notice of Reassessment was finalized by the CRA.

Another avenue that taxpayers in this situation must be aware of is the time extension. If the taxpayer is looking for an extension to appeal then he or she has one year after the 90-day time limit has lapsed to submit the application.

Two Different Procedures

Conducted in the TCC

INFORMAL

To begin, this procedure is open for professionals and non-professionals alike to appear. One may be qualified to proceed under the Informal Procedure if:

The disputed amount of federal tax and penalties is not more than $25,000 per assessment;

The disputed loss amount is not more than $50,000 per determination or

Interest on federal taxes Audit and on penalties is the only matter in dispute

It should be noted that the TCC is known to be more flexible in its application or the rules of evidence and that there is no filing fee for an appeal under this procedure.

GENERAL

If you do not qualify to have your appeal heard under the informal procedure, the TCC will hear your appeal under the general procedure.

The disputed amount is not relevant in this type of procedure.

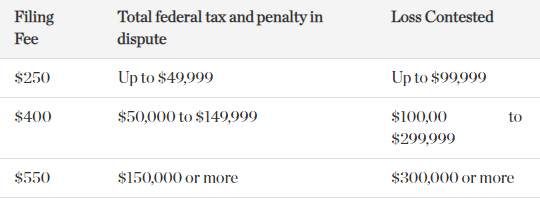

Unlike the Informal Procedure, the TCC requires a filing fee to accompany your Notice of Appeal:

Filing Fee: $250

Total Federal Tax & Penalty in Dispute: Up to $49,999

Loss Contested: Up to $99,999

Filing Fee: $400

Total Federal Tax & Penalty in Dispute: $50,000 to $149,999

Loss Contested: $100,000 to 299,999

Filing Fee: $550

Total Federal Tax & Penalty in Dispute: $150,000 or more

Loss Contested: $300,000 or more

An individual tax appellant has two representation choices: (1) the individual taxpayer can represent itself; or (2) the individual taxpayer can be represented by a lawyer. Unlike an individual, a Corporate entity MUST be represented by a lawyer.